How an investment of $1,000 made me a profit of $200 in a single day, while many investors struggle for 5 to 10% annual returns.

I’m sure you may think I’m lucky, but this is not the first time, and I’m not a beginner. However, I agree that it’s not a piece of cake.

This article can provide you with great value and knowledge beyond your skills and expertise if you are not an investor.

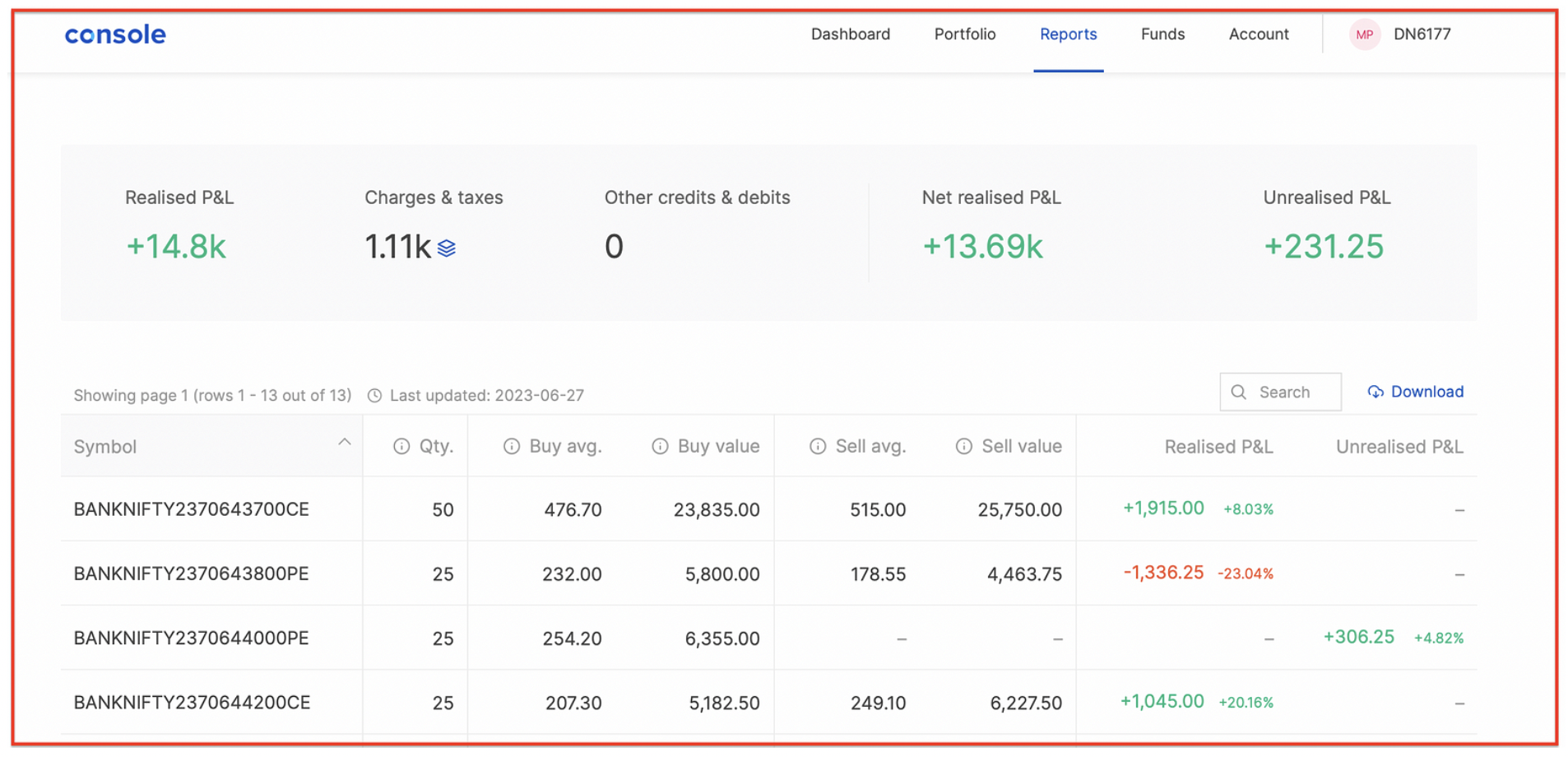

Before we delve into the details, here’s the proof!

Yes, it’s possible, and there are days when I doubled my investment in a single day, and sometimes lost all the money I had.

It was a game of luck until I lost my first $8,000 in stocks, not all at once but within a year, until I realized what was missing.

Believe me, even today, it’s not necessary for me to make $200 daily. Sometimes, I only earn $10 a day, $50, or even experience losses of $20 to $50 in a day, but I keep my losses under control.

💡 Remember: In the stock market, controlling your losses makes you a good trader and investor, rather than focusing solely on how much you can make.

I experience losses almost daily, even today, but I generate more profit than losses, which allows me to come out profitable with minimal losses.

As you can see in the screenshot above, I have made a profit of Rs 14.8k (~$200), but over the course of 13 days, some of them resulted in losses. One of these losses is clearly visible in red.

Yes, with practice and knowledge, you start to understand when to enter a stock and when to EXIT from the stock.

Today, I was only able to make a profit of $10, and I will share a screenshot if you join my newsletter here.

However, there is a catch.

I mean, why was I able to make ~$200 just by investing $1,000 in a single day, while many renowned investors strive for 10 to 15% annual returns or 99% of people experience losses?

Well, that’s the thing I’m going to share. Whether you are an investor, trader, or simply a loyal follower seeking to boost your knowledge, it will help you tremendously.

💡 Disclaimer: This is not financial advice; it is solely for educational purposes. If you need to learn more, you can contact me, but please note that I am not a financial planner.

How I Made $200 in a Day?

As I mentioned above, I was trading in the stock market in my free time yesterday, just like many other days, and I found an opportunity there.

HDFC Life stock, which I had been tracking for several days, showed a strong buying trend. However, due to a correction (fall) the day before yesterday, its price reached its lowest point.

I was initially reluctant to trade, but considering the strong uptrend it had been showing for several days, along with positive fundamentals of the company and its peers, I saw a great buying opportunity.

I assessed a good risk-reward ratio, meaning there was more to gain than to lose. Based on my analysis, I was 85% certain that the stock would go up, and it worked.

HDFC showed a 3% gain in stock price, and since I had invested in the HDFC Life futures options segment, I earned a significant profit of 80% on my invested amount.

To mitigate risks, I always hedge my stocks to stay safe, even if my analysis fails. However, it’s worth noting that I also experienced a 99% loss on an investment that went against the trends. So, it’s crucial not to panic and manage risks effectively.

💡 Tip: In options trading, if the stock price goes up by 2 to 3%, there is a high chance that the option premium will increase to 80% to 200% of its initial price.

Are you confused?

Let me explain. I bought an HRFC call option based on my research that it would go up, and at the same time, I bought a put option in case it went down.

Together, the amount I invested in both options had a difference of approximately $100. I invested around $450 in the call option and approximately $120 in the put option.

Therefore, even after losing all the ~$100 I traded in the put option, I made a profit of ~$300 in the call option. By doing some basic math, you will find this:

$300 — $120 = $180… ~200.

Yes, since trading in the options segment, I achieved an 80% to 85% return, but I also experienced a 99% loss.

💡 Note: If you trade in the options segment, there is a concept called time dilation. Don’t forget this and ensure proper analysis or seek expert advice before starting trading.

I have tracked more about this strategy in my previous post which you can read here.

The Bottom Line

Trading can be a great way to make good money whenever you like, but it’s not for everyone who just wants to try their luck.

I must say, seek advice from an expert financial consultant before you start trading and investing.

Trading in the options segment can provide opportunities for significant returns, ranging from 10% to 500%.

However, it’s essential to keep in mind that there is also the risk of substantial losses, as high as 99%. Careful analysis, risk management, and seeking expert advice are crucial when engaging in options trading.

Do you think this post was valuable?

I would love to share great articles, offers, and learning materials that you will hardly find elsewhere, summarising my years of experience.

Subscribe to my mailing list and never miss an update.

Thanks